PrimeNet User Guide

What to expect after my first login:

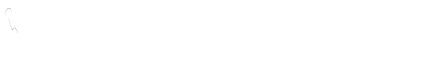

The login page below will be shown where you will key in your User Id, Sign-On password, and the Captcha

characters during login.

The system will prompt you to change both your Sign-On and Transaction password during the first login.

Make sure your passwords include Uppercase and Lowercase Alphabets, Numbers, and Special Characters.

The system will also prompt you to set 5 Security Questions which will be used for Self-Password Reset. For

Retail Users, need to select the Security Image and Phrase as added security features.

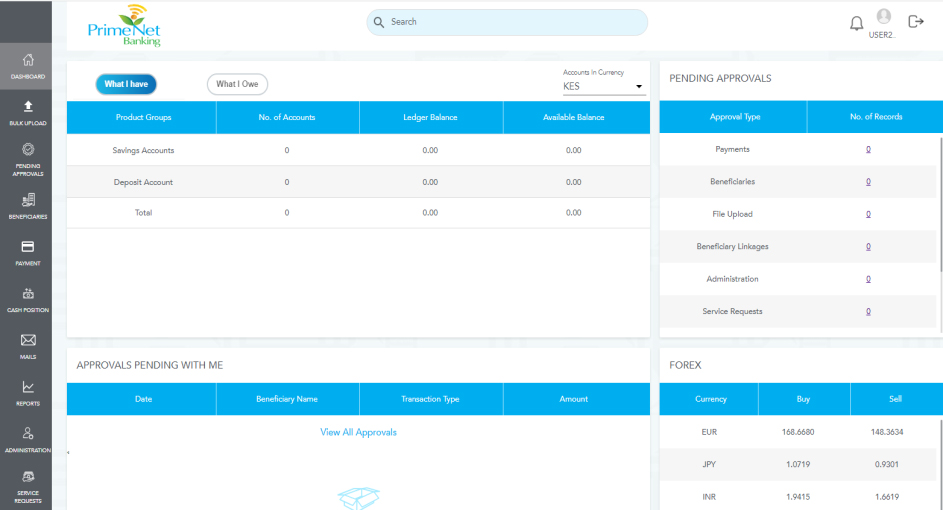

You will land on the Dashboard page after login. The following details will be shown on Dashboard page:

- What I have widget: Lists all the Operative accounts held in the bank and the balances in the accounts.

- What I Owe: Shows the Loan accounts, Overdraft accounts and other liabilities.

- Approvals pending with me: This will list all transactions pending your approval.

- Recent transactions: This will show the last 10 transactions on the selected account.

- Forex: This will show the exchange rates for different currencies for the day.

- Pending Approvals: Summary of different transaction types pending for approval under the corporate

You can access the following services on PrimeNet Internet Banking platform:

Bulk Payment:

This can be used for processing Salaries/Bulk Payments. There are 6 product types available for Bulk Upload as below:

- EFT Transfer to other Bank Accounts

- M-PESA File Upload

- Pesalink Account to Account

- Pesalink Account to Phone

- RTGS Transfer

- Transfer to Prime Bank Accounts

Sample file format for each product type is available for downloading once you click on “UPLOAD NEW” button and the product type is selected. You can also validate the file format by clicking on “VALIDATE” button.

Pending Approvals:

This shows approvals “Pending with me” (for transactions initiated by other users) and approvals pending for transactions “Initiated by me”.Beneficiaries:

This menu allows you to Create/Add new beneficiary as well as search existing counterparties maintained for effecting payments under different payment types/networks.Payments:

This module allows you to initiate single transfers/payments within Prime Bank, EFT, RTGS, SWIFT, PESALINK, M-PESA, Bill Payments and KRA i-Tax payments.

You can also search transactions where status is categorized as All, Success, Failed, Awaiting approvals, Scheduled or Draft for various dates and currencies as well.

Cash Position:

This displays the overall view of all accounts held in the bank in a graphic illustration.

Real Accounts – This displays all the accounts classified as either Current, Savings, Deposits, Overdraft, and Loans. You can view closed accounts as well under this module. Account statements can also be generated for each account under the real Accounts. You can generate statements for the accounts for various predefined periods (i.e., 1 Month, 3 Months, 6 Month) as well as for a date range.

Administration:

This module will be availed to the clients upon request. The admin can perform various functions as below:- Transaction Management – Admin can set up and define the User Roles, Rules, Financial & Non-Financial workflows, Transacting limits and set up personalized date range for statement inquiry.

- Corporate Management – Admin users can set up Account Preferences, Divisions and Inquire on corporate user activities.

- Corporate Dashboard – Shows a snapshot of defined Rules, Users set up, Defined user roles, Daily limits setup.

- Client Profile – Displays company information as per bank’s records.

Service Requests:

This module will allow clients to make Online requests (i.e., submitted to back-end systems in real time) and Offline requests (which will be sent to the Relationship Manager of parent branch or Head Office).

Offline Service Request includes below:

- Request for a Cheque Book

- Request for a Bankers Cheque/Demand Draft

- Request for Certified /Combined Statements of Accounts

- Premature Term Deposit Closure

- Interest And Withholding Tax Summary

Online Service Request includes below:

- Stop a Cheque Payment.

- change OTP Mode (i.e., SMS, Email or Both)

- Deposit Rates Inquiry

- Change Maturity Instruction for a Deposit Account

My Profile:

This can be accessed on the top right of your screen upon login. The module displays the User’s profile. The user can edit their profile, attach a profile photo, and even change the password. It displays the contact details maintained for the account; phone number, email address as well as the user transaction limits.FREQUENTLY ASKED QUESTIONS (FAQs)

Q. What is PrimeNet Internet Banking?

PrimeNet Internet Banking is a web-based service, facilitating the execution of both online and offline transactions through the internet. It is convenient and easy to use and allows you to securely process your banking payments through the Internet 24/7/365 at your comfort.

Q. What can I do on PrimeNet?

PrimeNet offers you access to the following services:

1. View and download your account details and activities

- Account statement

- Cheque Image retrieval

- Deposit Account details

- Loan Account details

2. Make Payments

- Transfers within your own accounts at Prime Bank

- ransfer to other accounts in Prime Bank

- Other local Banks transfers through EFT/RTGS/M-Pesa/Pesalink

- KRA i-Tax Payments

- Bulk Payments e. g. EFT/RTGS/Within Prime Bank/M-Pesa/Pesalink

- SWIFT/Telegraphic Transfers

- Scheduled and Recurring Payments

3. Utility Payments Subject to participating companies

- Nairobi Water, Zuku, Dstv, GoTv, Startimes, Cableone etc.

Q. What are the different modes of accessing PrimeNet?

PrimeNet can be accessed via below modes:

1) PASSWORD

When you request for a new password, a PDF document is generated by the system which contains your Sign-On, Transaction or Both passwords (based on the respective password generation request). It will be emailed to you on the Mail-id registered in the Bank’s record and will be password protected. The One Time Password (OTP) will be sent on your registered Mobile Number as per Bank’s record.

The Sign-On password is used to login into the internet Banking system. The transaction password enables a user to carry out both Financial and Non-Financial transactions through PrimeNet Internet Banking which must be keyed in every time you make a transaction.

2) SECURE TOKEN

Q. What is a Secure Token?

This is a secure two factor authentication device used by a client when logging into the system and when authorizing transactions. The tokens available to the clients for use are either the RSA Hardware dongle or The RSA Software Token phone app. The dongle generates a random 6-digit number while the soft token app generates a random 8-digit number, which the user must input while carrying out an online transaction.

Q. What is the difference between a PIN Mailer PDF and a Secure Token?

The PrimeNet Hardware token generates a random 6-digit number while the token mobile app generates a random 8-digit number that the client will use.

The token number cannot be re-used in the system. A PDF PIN Mailer on the other hand consists of a Sign-On Password and a Transaction password. These passwords expire after 90 days however a user can change the same any time before expiry period.

Q. Which transactions require me to use the transaction password?

All payments and transfers from your account through Internet Banking, and Service Requests will require you to input the transaction password.

Q. How secure is PrimeNet Internet Banking?

The latest electronic encryption technology ensures the secure transfer of information over the Internet. The use of https:// in the URL shows that the website is secure and safe. The Bank has adopted the latest security protocols into the internet Banking channel. Prime Bank website reflects the importance of this issue because your account security is of paramount importance to us. You’ll be allowed to change your own password, and all information sent and received is encrypted for your security.

Q. What do I need to access this service, how does it work and is there a specific browser/devices that I as a user am supposed to use?

All you need is a Desktop Computer/Laptop/Tablet that is connected to the Internet and any browser of your choice i.e., Microsoft Internet Explorer, Microsoft Edge, Google Chrome or Safari. Once you are on the internet, type in the URL https://www.primebank.co.ke and click on “Login to Internet Banking” link. You will be re-directed to PrimeNet Internet Banking login page. Key-in your Internet Banking User Id and Sign-on password and click on LOGIN button.

Q. What if I forget my User id and Password?

To retrieve your User ID, please use “Forgot User Id” option provided on the Login page. Alternatively, you can request User ID via the Branch.

For regeneration of your PrimeNet credentials, kindly fill up the “PRIMENET PASSWORD PIN RESET APPLICATION FORM” that can be downloaded from the Bank’s website. Once filled up, you can submit it to the Branch. You will receive Password protected PDF with credentials on your registered mail id. You will receive OTP on your registered Mobile Number to open the PDF.